- About Us

- Services

-

-

-

Overview

- Getting started

Easy process with an expert tax preparer

- US expat tax return

No matter where you reside — you must file US tax returns

- Streamlined procedure

No matter where you reside — you must file US tax returns

- Non-resident tax preparation

TFX helps non-US aliens or Green Card holders file returns

- Tax preparation fee calculator

Discover the average cost of tax return preparation for you

- Free intro consultation

Get started call with tax preparer

- Tax planning

High-level phone consultations with experts

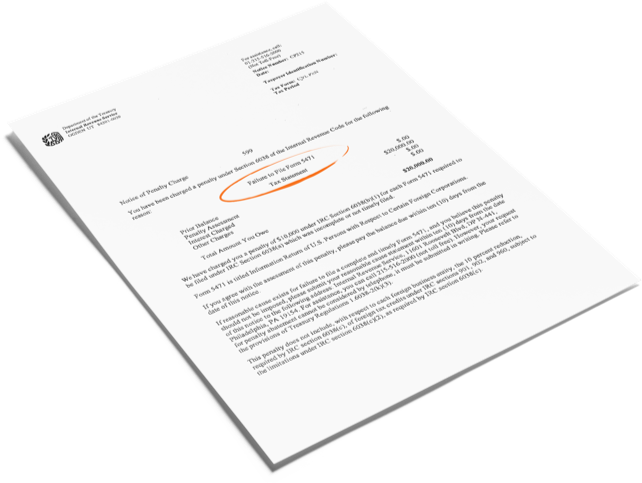

- IRS letters review

Scary letter from the IRS? TFX can help

- Tax projection

Selling stocks? New job? Make educated financial decisions

- Substantial presence test calc

Easily determine your US tax residency status

Pricing plans

- Core ($450)

Form 1040 federal tax return package

- Premier ($525)

For those with additional income sources beyond the core package.

- Streamlined procedure ($1,450)

For those who have not filed and want to become compliant with amnesty from penalties.

-

-

-

-

- Pricing

- Tax Guide

- Contact

- About Us

- Services

-

-

-

Overview

- Getting started

Easy process with an expert tax preparer

- US expat tax return

No matter where you reside — you must file US tax returns

- Streamlined procedure

No matter where you reside — you must file US tax returns

- Non-resident tax preparation

TFX helps non-US aliens or Green Card holders file returns

- Tax preparation fee calculator

Discover the average cost of tax return preparation for you

- Free intro consultation

Get started call with tax preparer

- Tax planning

High-level phone consultations with experts

- IRS letters review

Scary letter from the IRS? TFX can help

- Tax projection

Selling stocks? New job? Make educated financial decisions

- Substantial presence test calc

Easily determine your US tax residency status

Pricing plans

- Core ($450)

Form 1040 federal tax return package

- Premier ($525)

For those with additional income sources beyond the core package.

- Streamlined procedure ($1,450)

For those who have not filed and want to become compliant with amnesty from penalties.

-

-

-

-

- Pricing

- Tax Guide

- Contact

- Past webinar: Tax credit expansion, new tax savings for expats in many countries (2023 court ruling) — Watch recording